- Category

- >Information Technology

Everything About Automated Trading Software

- Vrinda Mathur

- Jul 13, 2023

Automated trading systems, also known as mechanical trading systems, algorithmic trading, automated trading, or system trading, enable traders to create specific rules for trade entry and exit that, once programmed, can be executed automatically by a computer. Indeed, according to several platforms, automatic trading algorithms account for 70% to 80% or more of shares traded on US stock exchanges.

Traders and investors can automate trading systems that allow computers to execute and monitor deals based on exact entry, exit, and money management rules. One of the most appealing aspects of strategy automation is that it can remove some of the emotion from trading by automatically placing transactions when certain conditions are satisfied.

What is Automated Trading Software?

If you've been wondering, 'What is auto trading?' or 'What is an automatic trading system?' you've come to the correct place. Automated trading software enables traders to specify criteria that determine both entry and exit points in financial markets, as well as money management guidelines. Once designed, the system monitors the desired market and executes transactions automatically.

The user-defined entrance and exit conditions might range from simple instructions to considerably more intricate and complicated techniques. The latter necessitates a detailed understanding of the programming language used by the appropriate trading platform.

Nowadays, automated trading software may be used to trade a wide range of markets, including stocks and Forex, and is available to anybody with a computer and an internet connection. Given that many people who begin trading have no expertise of the trading process or financial markets, the popularity of these techniques is unsurprising.

Algorithmic trading is another term for automated trading, and it simply refers to the use of algorithms to manage investments ranging from standard equities to cryptocurrency. All you have to do is develop a trading strategy and a set of rules similar to the ones you normally use for your transactions; based on this information, your unique algorithm will handle your investments on your behalf. The price at which a trade is opened or closed, the timing of an investment move, and, of course, the value at which a financial item is bought and sold are all elements addressed in algorithmic trading.

Before entering or terminating a transaction, a good automated trading system will perform an automatic financial analysis. The goal of automated trading is to make trading more time-efficient and less emotional. You may invest without continually monitoring the market, and the system identifies chances for you, saving you time on market research.

Automated trading is used in a variety of marketplaces, but it is notably popular among forex traders. AtoZ Markets is a signal source that provides automatic trading software that is both smooth and efficient. They created an algorithm with the help of market specialists to provide its users with a smoother and more pleasant forex trading experience.

Also Read | 10 Best Automated Trading Software

Top Automated Trading Software

Big data makes trade automation more convenient for retail investors these days. Furthermore, data analysis has grown more manageable, and data models are now available through drag-and-drop wizards and strategy builders.

The number of data points is more than ever before, ranging from time-based to tick-by-tick data. As a result, ordinary traders and investors can gain low-cost access to that data. Some of the top trading softwares are listed below:

-

EToro:

eToro is our top recommendation for automated trading software. You can put some or all of your portfolio on autopilot with eToro's copy trading feature. Copy trading at eToro allows you to mirror the moves of professional traders. You may choose which traders to follow based on their previous performance, trading style, and recent positions.

-

TrendSpider:

TrendSpider is a high-end stock analysis platform with strong technical and fundamental research features. Up to 16 charts can be monitored simultaneously, hundreds of trading indicators are available, and manual and automated sketching tools aid in the visualization of trends, support and resistance zones.

Using the integrated trading bots functionality, traders and investors may automate tactics without having to write code. Every trading technique can be converted into a fully automated trading system by users. Trading signals can be streamed to a discord server or Twitter, or they can be routed straight to the broker to place trades in a brokerage account.

-

Interactive Brokers:

One of the most robust brokerage solutions for automated trading systems is the Interactive Brokers API. The API is used by developers to create custom trading apps, commercial finance and trading tools, and to integrate trading functionality into their existing front-ends and apps.

Because the API is so popular, several market-leading trading tools already include connections to Interactive Brokers. The advantage is that trading tools, SAAS solutions, and self-developed trading system front-ends can send buy and sell orders straight from the external platform to Interactive Brokers for order processing.

-

Profit from NFT:

Another automated crypto trading platform is NFT Profit. NFT Profit, on the other hand, auto-trades NFTs (non-fungible tokens) rather than Bitcoin or other popular cryptocurrencies.

NFTs are generally used to represent digital art or other collectibles, hence NFT Profit is more analogous to a fine art trading platform than a crypto robot. The platform's AI system examines prior sales data and a variety of other characteristics to discover NFTs selling at low prices, and then turns around.

-

AlgoNomics:

AlgoNomics is a free algo trading software that uses a variety of trading tactics to assist traders avoid losses. Users can create their own plans or use the software's pre-defined strategies. Furthermore, traders can utilize various strategies when trading, which can be paused, interrupted, or modified at the user's discretion.

-

TeslaCoin:

TeslaCoin is a cryptocurrency as well as one of the greatest cryptocurrency auto trading systems. TeslaCoin allows you to automatically trade popular cryptocurrencies such as Bitcoin, Ethereum, and Bitcoin Cash.

What distinguishes the site is that funds in your account are housed in TeslaCoin, which has its own appreciation potential. Using TeslaCoin also allows the trading robot to swiftly switch between cryptocurrencies. TeslaCoin does not provide historical performance data, however assessments of this automated Bitcoin trading software are quite positive. Furthermore, TeslaCoin claims to use stop losses to limit your trading risk as minimal as possible.

Also Read | A Beginner’s Guide to Forex Trading

Pros of Automated Trading Software

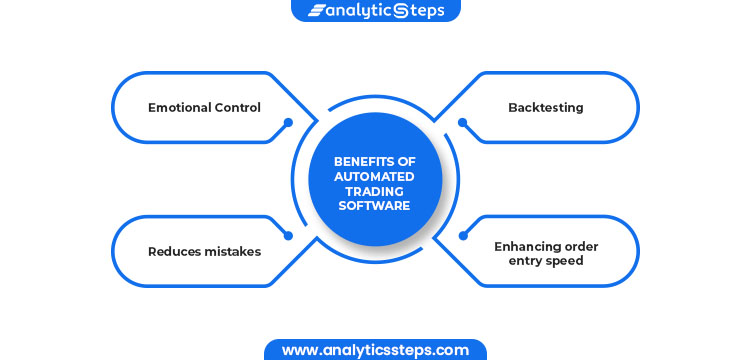

There are numerous benefits to having a computer watch markets for trading opportunities and execute trades, including:

Benefits of Automated Trading Software

-

Emotional Control:

Throughout the trading process, automated trading systems reduce emotions. Traders often have an easier time sticking to the plan when they keep their emotions in check. Traders will not be able to hesitate or question the trade because trade orders are executed automatically once the trade rules are met. Aside from assisting traders who are hesitant to "pull the trigger," automated trading can discourage individuals who are prone to overtrading - buying and selling at every apparent opportunity.

-

Reduces mistake:

As the saying goes, machines are more efficient than humans in carrying out orders that do not require the subjective application of mind. For example, if you want to make an order for only 100 shares, there is a chance that your trader will mishear you and put an order for 1000 shares. The same cannot be said for a machine, which will be exact in following directions.

-

Backtesting:

Backtesting evaluates the validity of a concept by applying trading rules to historical market data. When building an automated trading system, all rules must be absolute, with no opportunity for interpretation. The computer cannot make educated guesses and must be informed exactly what to do. Traders can test these specific sets of rules on historical data before putting money at risk in actual trading. Backtesting carefully allows traders to analyze and fine-tune a trading idea, as well as calculate the system's expectancy - that is, the average amount a trader may expect to win (or lose) per unit of risk.

-

Enhancing Order Entry Speed:

Since computers react instantly to changes in market conditions, automated systems can produce orders as soon as trade criteria are met. Getting into or out of a transaction a few seconds earlier can make a significant difference in the outcome of the trade. All additional orders, including protective stop losses and profit targets, are automatically produced as soon as a position is registered. Markets may move quickly, and it can be discouraging to see a trade hit a profit target or blast beyond a stop-loss level before the orders can even be executed. This is avoided by using an automated trading system.

Cons of Automated Trading Software

Every stock market strategy, system, or model has a number of advantages over other types of trading tactics. It does, however, have significant drawbacks. The same is true for automated trading. To help you better understand this trading method, consider the following disadvantages of automated trading:

-

Failures in Technology:

Automated trading is only as good as the automated system used to execute orders. However, because automated systems rely on technology, they can malfunction or encounter technical breakdowns. If this occurs, traders may suffer significant losses because the outcome may be negative due to inadequate execution.

-

Monitoring:

Although it would be ideal to turn on the computer and walk away for the day, automated trading systems do want supervision. This is due to the possibility of technology failures, such as connectivity troubles, power outages, or computer breakdowns, as well as system idiosyncrasies. An automated trading system may encounter anomalies that result in erroneous orders, missing orders, or duplicate orders. These events can be discovered and rectified immediately if the system is monitored.

-

Over-optimization:

Automated trading necessitates traders selecting, adjusting, and managing their trading strategy. Backtested techniques devised by traders, on the other hand, may look good on paper but fail in the live market when executed.

-

Server-Side Automation:

Traders can use a server-based trading platform to run their automated trading systems. These platforms commonly sell commercial methods to traders, allowing them to develop their own systems or host current systems on the server-based platform. The automated trading system may scan for, execute, and monitor trades for a charge, with all orders stored on the server. This frequently leads to potentially faster and more reliable order entry.

-

Technical knowledge is required:

Trades in automated trading necessitate technical understanding of coding, programming, and software administration. Because the process of developing automated systems is complex, trading with poor systems can result in massive losses for traders.

Finally, while tempting for a variety of reasons, automated trading systems should not be seen as a replacement for meticulously conducted trade. Technology breakdowns might occur, and as a result, these systems must be monitored. Server-based platforms may be a viable option for traders looking to reduce the risks of mechanical failure. Remember that before you utilize automated trading systems, you need to have some trading expertise and understanding.

Trending blogs

5 Factors Influencing Consumer Behavior

READ MOREElasticity of Demand and its Types

READ MOREAn Overview of Descriptive Analysis

READ MOREWhat is PESTLE Analysis? Everything you need to know about it

READ MOREWhat is Managerial Economics? Definition, Types, Nature, Principles, and Scope

READ MORE5 Factors Affecting the Price Elasticity of Demand (PED)

READ MORE6 Major Branches of Artificial Intelligence (AI)

READ MOREScope of Managerial Economics

READ MOREDifferent Types of Research Methods

READ MOREDijkstra’s Algorithm: The Shortest Path Algorithm

READ MORE

Latest Comments

arunbalajisrmtechc5abf25a9e374f7d

Jul 13, 2023https://www.srmtech.com/knowledge-base/blogs/decision-intelligence-use-cases/

forexinsights24544d28b1b1ea41c2

Jul 17, 2023Take action to secure your portfolio XAUBOT is XAUUSD Expert Advisor powered by machine learning and specifically for trading Gold. Gold Trading Bot trade automatically and you can withdraw profits anytime.

debbiearnold722

Jul 19, 2023I am out here to speed this good news to the entire world on how I got help from Dr Kachi a great lottery spell caster that will help you cast a lottery spell and give you the rightful numbers to win the lottery, I didn't believe lottery spell at first but as life got harder i decided to give a try, I spend so much money on tickets just to make sure I win. until the day I met Dr KACHI online, which so many people have talked good about, that he is very great when it comes to casting lottery spell, he told me the necessary things to do and behold it was like a magic, i won $20 Million Dollars Florida Powerball Double Play with the numbers Dr Kachi gave to me. his a really trustful person worthy and reliable, i am sharing this to you who have been finding it so hard to win the lottery, Thanks you Dr. Kachi who helped me contact email drkachispellcast@gmail.com OR Text Number and Call: +1 (209) 893-8075 Visit his Website: https://drkachispellcaster.wixsite.com/my-site

debbiearnold722

Jul 19, 2023I am out here to speed this good news to the entire world on how I got help from Dr Kachi a great lottery spell caster that will help you cast a lottery spell and give you the rightful numbers to win the lottery, I didn't believe lottery spell at first but as life got harder i decided to give a try, I spend so much money on tickets just to make sure I win. until the day I met Dr KACHI online, which so many people have talked good about, that he is very great when it comes to casting lottery spell, he told me the necessary things to do and behold it was like a magic, i won $20 Million Dollars Florida Powerball Double Play with the numbers Dr Kachi gave to me. his a really trustful person worthy and reliable, i am sharing this to you who have been finding it so hard to win the lottery, Thanks you Dr. Kachi who helped me contact email drkachispellcast@gmail.com OR Text Number and Call: +1 (209) 893-8075 Visit his Website: https://drkachispellcaster.wixsite.com/my-site

mamyers898

Jul 27, 2023WSJ today published a report about informing the General public that, It has been Approved and Confirmed by Us that ( HQRECOVERY22 at G M A I L dot C O M ) is a Certified and 100% Efficient Fund Recovery Expert. BITFINEX is giving them all the credit for their commendable effort in the Recovery and Successful return of our 2016 stolen BTC. We want to Recommend their services, And the General public is Safe to do business with them. And Pleas Note; They do not receive any Upfront Payment. Contact their support team for further assistance: HQRECOVERY22 at G M A I L dot C O M You Can Whatsapp or Text: + 1 3 2 3 3 8 8 5 7 1 5 NO UPFRONT PAYMENT! 303 Second St., Suite 900 South Tower, San Francisco, CA 94107 Thank me later.

mamyers898

Jul 27, 2023WSJ today published a report about informing the General public that, It has been Approved and Confirmed by Us that ( HQRECOVERY22 at G M A I L dot C O M ) is a Certified and 100% Efficient Fund Recovery Expert. BITFINEX is giving them all the credit for their commendable effort in the Recovery and Successful return of our 2016 stolen BTC. We want to Recommend their services, And the General public is Safe to do business with them. And Pleas Note; They do not receive any Upfront Payment. Contact their support team for further assistance: HQRECOVERY22 at G M A I L dot C O M You Can Whatsapp or Text: + 1 3 2 3 3 8 8 5 7 1 5 NO UPFRONT PAYMENT! 303 Second St., Suite 900 South Tower, San Francisco, CA 94107 Thank me later.

josyjacklinec73a38d8778b4b1a

Jan 05, 2024Hello, everyone. My name is Jackline. Yes, indeed recovery of your lost funds/Crypto is possible because I was once a victim of those scammers. My experience investing in bitcoin and losing money to scammers is something I'm willing to talk about. I believe you to be wise, do not make the same mistake I had made in the past. I’m very thankful for the help of GEO COORDINATES HACKER for helping recover my founds back, and I’m glad there is a safe way to fully recover crypto assets since the authorities cannot do anything to help get back lost funds. GEO COORDINATES HACKER was able to help me trace these conmen with their sophisticated cyber security system. You can get your stolen bitcoins back, though GEO COORDINATES HACKER. You can easily contact his service with the following information. geocoordinateshacker@proton.me. geovcoordinateshacker@gmail.com

hansonp6022c984a86b8bf4ae6

Jan 27, 2025THE HACK ANGELS RECOVERY EXPERT ENABLED ME RECOVER MY STOLEN CRYPTO BACK Losing your hard-earned digital assets, particularly cryptocurrency, can be a devastating and disheartening experience. I'll never forget the day I fell victim to crypto fraudsters. I had invested a significant amount of money, $967,000, in what I thought was a legitimate cryptocurrency platform, but it turned out to be a sophisticated and well planned cryptocurrency scam. I lost everything - my entire investment, gone in an instant with no knowledge of what to do or whom to turn to for help in my distress. I was devastated, feeling like I'd been punched in the gut. I didn't know where to turn or who to trust. I felt like I'd never see my money again. Desperation led me to search tirelessly for a solution.That is when I discovered THE HACK ANGELS RECOVERY EXPERT A trusted friend recommended them to me, saying they specialized in recovering lost funds from crypto scams. I was skeptical at first, but desperate for a solution I had to reach out to them through their contact. For anyone in a similar situation seeking to recover funds lost to online scams. You can contact them through their hotline WhatsApp +1(520)200-2320) Email at (support@thehackangels.com). Website (www.thehackangels.com) I highly recommend contacting THE HACK ANGELS RECOVERY EXPERT. They’ll ensure you get your money back in full. If you're in London, you can even visit them in person at their office located at 45-46 Red Lion Street, London WC1R 4PF, UK. They’re super helpful and really know their stuff! Don’t hesitate to reach out if you need help!