- Category

- >Machine Learning

Impact of Machine Learning on Asset Managers

- Taniya Ahmed

- Jan 02, 2024

- Updated on: Sep 30, 2023

In the fast-paced world of finance, staying ahead of the curve is not just a goal; it's a necessity. Asset managers, entrusted with the responsibility of safeguarding and growing their clients' investments, understand this better than most. Over the years, they have seen their industry undergo a profound transformation, driven by technology and innovation. Among the most groundbreaking developments in this ongoing evolution is Machine Learning (ML), a force that has redefined the way asset managers navigate the complex and volatile world of financial markets.

Gone are the days when asset management relied solely on human expertise and traditional quantitative models to make investment decisions. Today, as data floods in from a multitude of sources and market dynamics shift with breathtaking speed, the role of the asset manager has expanded to encompass not only financial acumen but also mastery of cutting-edge technology.

In this blog, we embark on a journey to explore the deep and intricate connection between machine learning and asset management, uncovering how this symbiotic relationship has given rise to unprecedented opportunities and challenges.

Machine Learning in Asset Management

Machine learning, a subset of artificial intelligence, revolves around the concept of teaching machines to learn from data and improve their performance over time without explicit programming. Asset managers deal with vast quantities of data, including market trends, financial reports, and economic indicators, to make informed investment decisions. This is where the synergy between machine learning and asset management comes into play.

Asset management, once primarily reliant on human expertise and traditional statistical models, has been quick to adopt machine learning techniques. Machine learning is a subset of artificial intelligence that enables computers to learn and make predictions or decisions without explicit programming to understand machine learning better.

Relevance to Asset Management

In asset management, where data-driven decisions and market insights are paramount, ML offers unparalleled advantages. Its relevance can be summarized in three key aspects:

-

Data Processing: Asset managers deal with vast and complex financial datasets. ML excels at processing this data swiftly and accurately, allowing asset managers to uncover hidden patterns, correlations, and market anomalies that may go unnoticed using traditional methods.

-

Predictive Analytics: ML models can predict asset price movements and market trends by learning from historical data. This predictive capability equips asset managers with tools to make informed investment decisions, optimize entry and exit points, and anticipate market shifts.

-

Portfolio Optimization: ML plays a crucial role in constructing and managing investment portfolios. By considering multiple factors such as asset correlations, volatility, and past performance, ML algorithms can create diversified portfolios that balance risk and return more effectively than traditional methods.

Now, let's delve into the various areas within asset management where ML is applied:

-

Data Analysis: ML techniques are instrumental in analyzing financial data. They can identify patterns, outliers, and trends within large datasets, providing asset managers with valuable insights for informed decision-making.

-

Predictive Analytics: ML models leverage historical data to forecast asset price movements and market trends. This predictive capability helps asset managers make timely investment decisions and anticipate shifts in the financial landscape.

-

Portfolio Management: ML assists in optimizing investment portfolios by considering a multitude of factors simultaneously. This includes asset correlation, volatility, and past performance, resulting in portfolios that are better diversified and more resilient to market fluctuations.

-

Risk Assessment and Management: ML algorithms excel in identifying potential risks associated with investments. They can analyze market conditions and financial indicators to assess and mitigate risks effectively, enhancing the stability of portfolios.

-

Algorithmic Trading: In high-frequency and algorithmic trading, ML algorithms execute trades at lightning speed based on real-time market data. They capitalize on arbitrage opportunities and market inefficiencies, optimizing trading strategies.

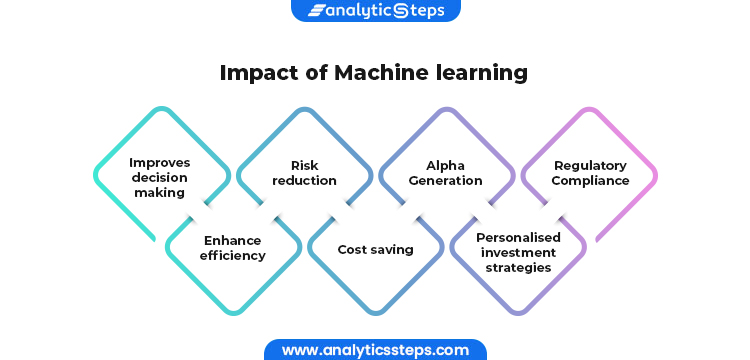

Impact of Machine Learning On Asset Managers

The integration of machine learning into asset management has had far-reaching impacts on the industry, ushering in a new era of efficiency and effectiveness. Here are some key impacts:

-

Improved Decision-Making: Machine Learning equips asset managers with data-driven insights that significantly enhance their decision-making capabilities. By analyzing vast amounts of historical and real-time data, ML models can identify trends, patterns, and correlations that human analysts might miss.

This enables asset managers to make more informed investment decisions, anticipate market movements, and adjust their strategies accordingly. ML-powered predictive models can offer a competitive edge by providing timely insights into potential opportunities and risks.

-

Enhanced Efficiency: Efficiency gains are among the most notable impacts of ML in asset management. Routine tasks like data analysis, portfolio rebalancing, and risk assessment can be automated using ML algorithms. This automation not only saves time but also reduces the risk of human error. Asset managers can redirect their efforts towards higher-level strategic thinking, client relationship management, and exploring innovative investment strategies. The result is a more streamlined and productive workflow.

-

Risk Reduction: Managing risk is at the core of asset management, and ML has proven to be a valuable tool in this regard. ML algorithms are capable of identifying potential risks associated with investments by analyzing various data sources, including market conditions, economic indicators, and historical data.

By detecting these risks early, asset managers can implement risk mitigation strategies more effectively, ultimately enhancing the stability and resilience of investment portfolios.

-

Cost Savings: Efficiency improvements through automation lead to cost savings for asset management firms. This can translate into lower fees for clients, making their investment services more competitive in the marketplace. Reduced operational costs can also enable asset managers to allocate resources to research and development, further enhancing their ability to deliver value to clients.

-

Alpha Generation: Alpha, or excess returns, is a key measure of performance in asset management. ML can contribute significantly to alpha generation by identifying unique investment opportunities that may not be apparent through traditional analysis.

ML models can process vast datasets to uncover hidden patterns and potential market inefficiencies. Asset managers who harness the power of ML can capitalize on these insights to deliver superior returns to their clients.

-

Personalized Investment Strategies: Client preferences and risk tolerances vary widely, and ML enables asset managers to create personalized investment strategies. By analyzing client-specific data and preferences, ML algorithms can tailor investment portfolios to meet individual goals and risk profiles. This level of personalization enhances client satisfaction and retention, a critical aspect of asset management success.

-

Regulatory Compliance: The financial industry is subject to complex and evolving regulatory requirements. ML can assist asset managers in meeting these compliance obligations by automating tasks such as compliance checks and reporting. This ensures that asset managers stay on the right side of the law while minimizing the administrative burden associated with regulatory compliance. .

Also Read | What Machine Learning means for Asset Managers | HBR

Challenges and Potential Risk

Regulatory challenges associated with using machine learning in asset management include:

-

Data Quality and Quantity: One of the foremost challenges in ML-driven asset management is the quality and quantity of data. ML models require large and diverse datasets for effective training and decision-making. Ensuring data accuracy, consistency, and relevance can be challenging, especially when dealing with historical or unconventional data sources. Garbage in, garbage out applies here, as ML models heavily depend on the quality of the input data.

-

Model Interpretability: ML algorithms, especially deep learning models, are often viewed as "black boxes" because they make decisions based on complex mathematical functions. Understanding and interpreting these models can be challenging. Asset managers must be able to explain model decisions to clients, regulators, and internal stakeholders, which can be difficult when the models themselves lack transparency.

-

Overfitting and Model Bias: Overfitting occurs when an ML model learns the noise in the data rather than the underlying patterns. In asset management, overfit models can lead to poor real-world performance and unexpected losses. Additionally, ML models can inherit biases present in historical data, potentially perpetuating systemic biases in investment decisions. Asset managers must be vigilant in addressing these issues to ensure fair and accurate results.

-

Regulatory Compliance: The financial industry is heavily regulated, and using ML models can pose challenges related to compliance. Regulators require transparency, fairness, and accountability in decision-making processes. Asset managers must navigate a complex regulatory landscape and ensure that their ML-driven strategies adhere to industry-specific regulations and ethical standards.

-

Human Oversight: While ML can automate many tasks, it's essential to maintain human oversight. Asset managers should strike a balance between automation and human judgment. Human expertise is crucial for validating model outputs, interpreting results, and making nuanced investment decisions, particularly in unusual or unpredictable market conditions.

-

Cyber security and Data Privacy: ML models require access to sensitive financial data, making asset management firms potential targets for cyber attacks. Protecting client data, trade secrets, and proprietary algorithms is paramount. Additionally, asset managers must comply with evolving data privacy regulations, such as GDPR and CCPA, which can impose strict requirements on data handling and protection.

-

Costs and Resource Allocation: Implementing and maintaining ML systems can be costly. Asset managers must invest in skilled personnel, infrastructure, and data resources. Decisions related to budget allocation for ML initiatives must be carefully considered to ensure a positive return on investment.

The Road Ahead: Future of ML in Asset Management

The future of asset management is likely to be heavily influenced by machine learning and other AI technologies. Here are some potential developments and trends in the industry:

-

Increased use of AI for data analysis: Asset managers are likely to increasingly rely on AI for data analysis, allowing them to generate ideas from data sourced and synthesized via machine learning.

-

Greater automation of investment strategies: The strategy innovation process can be automated using machine learning tools or data, although human involvement will still be critical for risk management and framework selection.

-

Improved investment decisions: Researchers have found that machine learning significantly improves investment decisions.

-

More accurate property valuation: In real estate asset management, AI can enable more accurate property valuation by accounting for factors like location, amenities, historical prices, market trends, etc.

-

Index providers partnering with Big Tech: Index providers may partner with "Big Tech" companies like Amazon, Apple, and Alphabet to become the largest asset managers.

-

Tokenization of assets: Technological advances may allow for the fractionalization of existing securities and financial assets, and the tokenization of physical assets and legal titles.

-

Augmentation of human portfolio managers with AI: A combination of AI and quantum computing could augment or even replace portfolio managers, as technology can absorb, analyze and process more information than any human.

The evolving role of asset managers in a machine learning-driven world is likely to involve a greater emphasis on technology, data, and digital capabilities. Asset managers will need to take a 360° approach to transformation, including reinventing the client experience, expanding into new investment products and strategies, and transforming their product distribution value chain.

They will also need to attract skilled employees who can implement, oversee, and manage these technologies. However, it is important to note that machine learning cannot replace human judgment, and human involvement will still be critical for risk management and framework selection.

Conclusion

In conclusion, the transformative impact of Machine Learning on asset managers is nothing short of revolutionary. As we've journeyed through this exploration, it's clear that the integration of ML has not only enhanced the capabilities of asset managers but has fundamentally reshaped the entire landscape of asset management.

With Machine Learning, asset managers are empowered to make more informed decisions, optimize portfolios, and mitigate risks more effectively. Efficiency gains, cost savings, and personalized investment strategies have become attainable, benefitting both clients and asset management firms. However, it's important to acknowledge that this transformation doesn't come without its challenges. Data quality, model interpretability, regulatory compliance, and the need for human oversight are crucial considerations in the responsible use of ML in asset management.

As we look ahead to the future, the role of asset managers is poised to evolve further. The adoption of AI technologies, combined with human expertise, will be essential for navigating the complexities of financial markets. While the road ahead may present its share of obstacles, the synergy between Machine Learning and asset management promises to unlock new horizons, ensuring that asset managers continue to thrive in an ever-changing and data-driven financial world.

Trending blogs

5 Factors Influencing Consumer Behavior

READ MOREElasticity of Demand and its Types

READ MOREAn Overview of Descriptive Analysis

READ MOREWhat is PESTLE Analysis? Everything you need to know about it

READ MOREWhat is Managerial Economics? Definition, Types, Nature, Principles, and Scope

READ MORE5 Factors Affecting the Price Elasticity of Demand (PED)

READ MORE6 Major Branches of Artificial Intelligence (AI)

READ MOREScope of Managerial Economics

READ MOREDijkstra’s Algorithm: The Shortest Path Algorithm

READ MOREDifferent Types of Research Methods

READ MORE

Latest Comments

Sharon Garner

Oct 04, 2024I fell victim to a fraudulent trading platform, losing $9500 in USDT to Beam Future Trading. After struggling to recover my funds, I sought help from Crypto Pandemic Hunter on my friend's recommendation. The team demonstrated excellent customer service, expertise in crypto, and cutting-edge technology. By analyzing the blockchain and collaborating with exchanges, they tracked down and successfully recovered most of my lost funds, providing me with immense relief. I highly recommend Crypto Pandemic Hunter for their swift and effective recovery services. Contact them at cryptopandemichunter@consultant.com

harisonheard34625f98d004604eaa

Oct 06, 2024HOW TO GET YOUR MONEY BACK THROUGH WEB BAILIFF CONTRACTOR Am a Forex scam victim that i involved in a scam that cost me CHF 300,000, hoping it helps others avoid a similar fate. It all began when I encountered what appeared to be a lucrative opportunity in forex trading. The promise of high returns was too tempting to resist, leading me to invest a significant sum. Initially, everything seemed fine; I made a few small gains that reinforced my belief in the platform's legitimacy.However, things quickly spiraled downward when I attempted to withdraw my funds. What started as minor withdrawal issues rapidly escalated into a barrage of requests for additional fees, all with little to no explanation. Each time I complied, they concocted new reasons for further delays, continuously asking for more money. It became painfully clear that I was caught in a sophisticated scam designed to extract as much money as possible from unsuspecting investors.Feeling desperate and helpless, I began searching for a solution. During my research, I came across Web Bailiff Contractor. Their name appeared frequently in online forums and reviews, where many individuals shared their success stories in recovering lost funds from scams, including forex trading schemes. The feedback was overwhelmingly positive, prompting me to reach out to them in hopes of a miracle.To my relief, Web Bailiff Contractor responded promptly and professionally. They guided me through the entire recovery process, reassuring me of their solid track record in handling such cases. Within just 48 hours, they managed to recover CHF 290,000—an efficiency and effectiveness that left me amazed.While my experience with Web Bailiff Contractor was a huge relief, it also served as a harsh lesson about the importance of due diligence in investing. Forex trading and other high-risk investments can be fraught with danger, especially if one is not cautious about the platforms they choose. Always verify the legitimacy of a trading platform, be wary of promises that seem too good to be true, and ensure you’re dealing with regulated entities.For anyone facing similar challenges, I strongly recommend seeking professional help rather than trying to navigate the situation alone. Your financial well-being deserves it.

alexanderpurcell631320c173c5024d99

Oct 09, 2024Investing in cryptocurrency can be a double-edged sword. While the potential for significant gains is enticing, the risks are equally substantial. Many individuals, drawn by the allure of quick profits, have fallen victim to scams that prey on their desire for financial growth. I, too, found myself ensnared in this web of deception, losing over $82,050 to a fraudulent broker, Financiale. My experience serves as a cautionary tale for anyone looking to venture into the world of crypto trading. my foray into cryptocurrency seemed promising. The market was booming, and with each successful trade, my confidence grew. However, my optimism blinded me to the signs of trouble. Financiale, which presented itself as a reputable trading platform, turned out to be a sophisticated scam. I watched helplessly as my funds dwindled, realizing too late that I had fallen victim to a scheme designed to exploit inexperienced traders like myself.The frustration and despair of losing such a significant amount of money were overwhelming. I tried to recover my funds through various channels, but my efforts were met with roadblocks and dead ends. It was a challenging period, as the pressure to recover my losses only compounded my stress. Many hours were spent researching strategies and potential recovery options, but each attempt felt increasingly futile. Just when I was about to lose hope, I came across a recommendation for Cyberpunk Programmers. Skeptical but desperate, I reached out to them, and that decision changed everything. MRS. Lucy, a skilled recovery specialist, took the time to understand my situation and assured me that they had a proven track record of helping individuals like me recover lost funds. Her professionalism and empathy were reassuring during a time when I felt vulnerable and defeated. The recovery process was meticulous but transparent. MRS. Lucy kept me informed at every step, providing insights into their strategies and techniques for navigating the complexities of online scams. To my astonishment, within a few weeks, Cyberpunk Programmers was able to reclaim 90% of my lost funds. The sense of relief I felt was indescribable, as I had nearly given up on the idea of ever recovering my money. My experience with Cyberpunk Programmers has been overwhelmingly positive, and I am immensely grateful for MRS. Lucy's expertise and dedication. I highly recommend their services to anyone who has fallen victim to online scams, especially in the unpredictable realm of cryptocurrency. Their commitment to helping clients recover lost funds is genuine, and they have earned my trust and appreciation. while the world of cryptocurrency offers exciting opportunities, it is essential to approach it with caution. Be wary of scams, and if you find yourself in a difficult situation, consider seeking help from professionals like those at Cyberpunk Programmers. Good work deserves recognition, and I am more than happy to share my experience in hopes of helping others avoid the pitfalls I faced. Their information is, Email: cyberpunk (@) programmer (.) net WhatsApp: +44 7848 161773

weinsilver25331b3d6dced4740ed

Oct 14, 2024WEB BAILIFF CONTRACTOR - A CERTIFIED BITCOIN RECOVERY TEAM I lost $231,000 to a fake cryptocurrency investment platform called Wizmoney. As a newcomer to the world of cryptocurrency, I was eager to invest but didn't fully grasp the risks involved. The platform appeared legitimate, and I was assured repeatedly that it wasn’t a scam. This false sense of security led me to invest a significant amount of money.However, everything changed when I attempted to withdraw my funds. My requests were met with silence, and my frustration grew as I paid additional fees for tax clarifications, believing this would unlock my investment. Instead, I found myself trapped in a web of deception. The support team was unresponsive, and it became painfully clear that I had fallen victim to a scam.Feeling violated and helpless, I thought I had lost everything. The emotional toll was immense, and I struggled with feelings of regret and despair. I began researching my options for recovery, determined not to give up hope. That’s when I discovered Web Bailiff Contractor. After reading about their expertise in dealing with crypto scams, I decided to reach out for help.The team at Web Bailiff Contractor was professional and understanding. They immediately initiated a thorough investigation into Wizmoney, gathering information and analyzing the fraudulent activities associated with the platform. Their approach gave me hope, and I felt a renewed sense of determination as they assured me they would do everything possible to recover my lost funds.Within just a week, I was amazed to learn that they had successfully retrieved my investment. Their dedication and technical prowess were evident throughout the process. They left no stone unturned, demonstrating a deep understanding of the cryptocurrency realm and the tactics used by scammers. Trusting them with my case was one of the best decisions I made during this ordeal.My experience serves as a crucial reminder of the risks associated with cryptocurrency investments. It's vital for investors, especially those new to the space, to conduct thorough research before committing funds. Moreover, if you find yourself a victim of a scam, don't hesitate to seek help from professionals. Thanks to Web Bailiff Contractor, I regained what I thought I had lost forever, and I urge others to be vigilant and proactive in protecting their investments,Send a message to Web Bailiff Contractor today via: WhatsApp them through ;+ 1(360)819 8556 or send an email to web @ bailiffcontractor . net Thanks.

weinsilver25331b3d6dced4740ed

Oct 14, 2024WEB BAILIFF CONTRACTOR - A CERTIFIED BITCOIN RECOVERY TEAM I lost $231,000 to a fake cryptocurrency investment platform called Wizmoney. As a newcomer to the world of cryptocurrency, I was eager to invest but didn't fully grasp the risks involved. The platform appeared legitimate, and I was assured repeatedly that it wasn’t a scam. This false sense of security led me to invest a significant amount of money.However, everything changed when I attempted to withdraw my funds. My requests were met with silence, and my frustration grew as I paid additional fees for tax clarifications, believing this would unlock my investment. Instead, I found myself trapped in a web of deception. The support team was unresponsive, and it became painfully clear that I had fallen victim to a scam.Feeling violated and helpless, I thought I had lost everything. The emotional toll was immense, and I struggled with feelings of regret and despair. I began researching my options for recovery, determined not to give up hope. That’s when I discovered Web Bailiff Contractor. After reading about their expertise in dealing with crypto scams, I decided to reach out for help.The team at Web Bailiff Contractor was professional and understanding. They immediately initiated a thorough investigation into Wizmoney, gathering information and analyzing the fraudulent activities associated with the platform. Their approach gave me hope, and I felt a renewed sense of determination as they assured me they would do everything possible to recover my lost funds.Within just a week, I was amazed to learn that they had successfully retrieved my investment. Their dedication and technical prowess were evident throughout the process. They left no stone unturned, demonstrating a deep understanding of the cryptocurrency realm and the tactics used by scammers. Trusting them with my case was one of the best decisions I made during this ordeal.My experience serves as a crucial reminder of the risks associated with cryptocurrency investments. It's vital for investors, especially those new to the space, to conduct thorough research before committing funds. Moreover, if you find yourself a victim of a scam, don't hesitate to seek help from professionals. Thanks to Web Bailiff Contractor, I regained what I thought I had lost forever, and I urge others to be vigilant and proactive in protecting their investments,Send a message to Web Bailiff Contractor today via: WhatsApp them through ;+ 1(360)819 8556 or send an email to web @ bailiffcontractor . net Thanks.

mailstephenatl77c36c1d89594336

Oct 26, 2024Individuals who have experienced the loss or theft of their cryptocurrency may face a significant and distressing situation that can leave them feeling both disoriented and helpless. However, amidst this darkness exists a glimmer of hope and illumination. A distinguished entity within the realms of digital asset recovery and cybersecurity, their impressive success rates serve as a testament to their expertise. This concise examination aims to shed light on the invaluable services offered by CYBER GENIE HACK PRO. A firm dedicated to retrieving lost or stolen Bitcoin and other digital assets. When in the process of selecting a recovery service, it is advisable to seek out those with favorable reviews and a history of successful recoveries. CYBER GENIE HACK PRO has accumulated a plethora of testimonials from pleased clients who have successfully reclaimed their stolen cryptocurrency, thereby reinforcing its standing as a dependable option within the ethical hacking and asset recovery sectors. WEB- https://cyber-genie-hackpro.info/ MAIL- cybergenie @ cyberservices . com T/G- cybergeniehackpro

quinceymurdock01acb0f4789b4679

Nov 04, 2024This is so amazing and real; at first, I thought it was a scam because I was duped by a number of people who said they could help me invest my money in bitcoin trading, which is how I lost $89,000 seven days ago. However, with the assistance of a legitimate hacker at Redeemed Hacker Pro, A hacking and stolen digital assets/BTC recovery agency, I was able to withdraw $200,000 from an ATM without leaving any trace, which is more than the money I lost seven days ago. I will continue to tell people about Redeemed Hacker Pro if you are in need of a legitimate hacker or have any financial difficulties in order to pay off debts and begin a new life. reach out to team Redeemed Hacker Pro now by visiting their Email & website at: redeemed.h.p@hackermail.com or redeemedhackerpro.wixsite.com/redeem-hacker-pro

quinceymurdock01acb0f4789b4679

Nov 04, 2024This is so amazing and real; at first, I thought it was a scam because I was duped by a number of people who said they could help me invest my money in bitcoin trading, which is how I lost $89,000 seven days ago. However, with the assistance of a legitimate hacker at Redeemed Hacker Pro, A hacking and stolen digital assets/BTC recovery agency, I was able to withdraw $200,000 from an ATM without leaving any trace, which is more than the money I lost seven days ago. I will continue to tell people about Redeemed Hacker Pro if you are in need of a legitimate hacker or have any financial difficulties in order to pay off debts and begin a new life. reach out to team Redeemed Hacker Pro now by visiting their Email & website at: redeemed.h.p@hackermail.com or redeemedhackerpro.wixsite.com/redeem-hacker-pro

marvinedwin27a6c50061e5634c69

Jan 02, 2025How many people throughout the world have lost millions of dollars as a result of falling for scammers? I personally lost over $482,000 in Canadian dollars. I was afraid to tell my wife or brothers that I had been duped out of all of my money. My friend eventually found Redeemed Hacker Pro's portfolio, and I used this reliable service to amazingly get half of my money back. Website: www.redeemedhackerpro.com or redeemedhackerpro.wixsite.com/redeem-hacker-pro; email: redeemed.h.p@hackermail.com

marvinedwin27a6c50061e5634c69

Jan 02, 2025How many people throughout the world have lost millions of dollars as a result of falling for scammers? I personally lost over $482,000 in Canadian dollars. I was afraid to tell my wife or brothers that I had been duped out of all of my money. My friend eventually found Redeemed Hacker Pro's portfolio, and I used this reliable service to amazingly get half of my money back. Website: www.redeemedhackerpro.com or redeemedhackerpro.wixsite.com/redeem-hacker-pro; email: redeemed.h.p@hackermail.com